Specialty containers not only play a unique role in ocean shipping, but the leasing market behind them is also a specialized and dynamic sector. Unlike shipping lines, which own containers, the leasing market offers shippers and logistics companies greater flexibility and choice.

I. Major Market Players

The global container leasing market is dominated by a few major players, and specialty containers, as a key component of their asset portfolios, are no exception. Major players include:

CAI International: One of the world’s largest specialty container leasing companies, with a large and diverse fleet.

Textainer: The world’s largest container leasing company overall, with a significant specialty container business.

Triton International: Another leasing giant, offering a variety of container types, including specialty containers.

Other regional leasing companies also provide specialized services in specific markets.

II. Factors Influencing Leasing Prices

The daily rental rate for specialty containers is influenced by a variety of factors and fluctuates significantly:

1. Supply and demand: This is the core factor. When China’s exports are strong (such as during concentrated shipments of new energy equipment), demand for specialty containers surges, leading to higher rents. Conversely, rents fall.

2. Container Type and Specifications: Platform containers typically command higher rents than flat rack containers, which in turn command higher rents than open top containers. Larger and heavier containers command higher rents.

3. Lease Length: Long-term leases typically offer more favorable unit prices than short-term leases.

4. Pickup/Return Location: Picking up and returning containers in areas with a high concentration of specialty containers (such as major ports) results in lower rents. Delivering containers to remote locations may incur additional transfer fees.

5. Market Empty Container Transfer Costs: Leasing companies need to balance container availability globally, and transfer costs are partially reflected in rent.

III. Current Market Status

Returning to Reason from the Pandemic’s Frenzy: Port congestion during the pandemic led to extremely low container turnover efficiency (including for special containers), causing rental rates to soar to historical highs. The market has gradually returned to normal, and rental rates have returned to reasonable levels, but are still subject to periodic demand fluctuations.

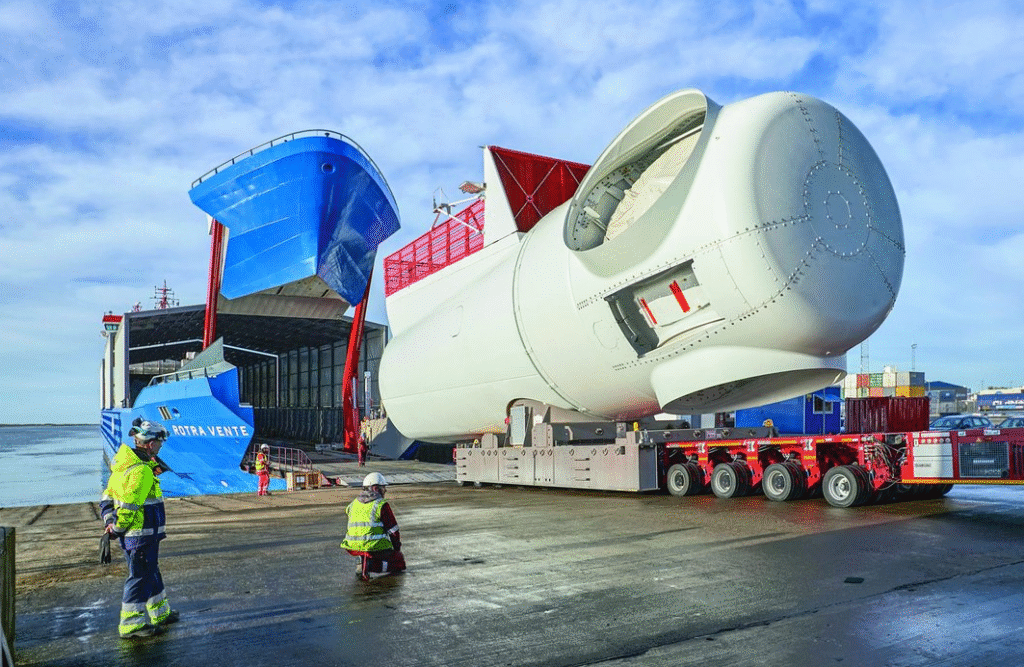

New Energy Drives Demand: As mentioned earlier, China’s rapid development in photovoltaics, wind power, and electric vehicles has provided a new and sustainable growth engine for the special container leasing market.

IV. Future Development Trends

1. Digital Management: Leasing companies are investing heavily in digital platforms, allowing customers to check inventory, receive quotes, book containers, manage leases, and handle container pickup and return procedures online, making the experience more convenient and efficient.

2. Asset Performance Optimization: Leveraging Internet of Things (IoT) technology, sensors are installed on special containers to monitor their location and status (whether they are vacant or require maintenance), thereby optimizing asset utilization and scheduling efficiency.

3. Green and Environmentally Friendly: Developing and using special containers made of lighter, more durable, and recyclable materials to reduce carbon emissions and lifetime maintenance costs. 4. Deepening Services: Leading leasing companies are transitioning from simply providing container rental services to offering one-stop equipment solutions, including value-added services such as lashing materials and repair and maintenance.

The specialty container leasing market is a barometer of global trade and the development of specific industries. For container leasing companies, understanding market dynamics, establishing long-term partnerships with reliable leasing companies, and planning ahead during off-season demand are key to obtaining the best prices and securing container supply.